An Unbiased View of Paul B Insurance

Wiki Article

Our Paul B Insurance Statements

Out-of-pocket prices (that is, sets you back apart from your month-to-month costs) are one more vital consideration. A strategy's recap of benefits should plainly outline just how much you'll need to pay of pocket for services. The government online marketplace provides snapshots of these prices for contrast, as do numerous state markets.

Coinsurance: This is the percentage (such as 20%) of a medical cost that you pay; the rest is covered by your medical insurance strategy. Insurance deductible: This is the amount you pay for covered treatment before your insurance policy begins paying. Out-of-pocket maximum: This is the most you'll pay in one year, out of your own pocket, for covered healthcare.

Out-of-pocket costs: These are all prices over a plan's premium that you must pay, including copays, coinsurance as well as deductibles. Costs: This is the regular monthly quantity you spend for your medical insurance plan. Generally, the higher your costs, the reduced your out-of-pocket costs such as copays and coinsurance (and vice versa).

By this step, you'll likely have your alternatives tightened down to simply a few plans. Below are some points to consider following: Inspect the scope of solutions, Go back to that recap of advantages to see if any one of the plans cover a broader range of services. Some may have better coverage for things like physical therapy, fertility therapies or psychological health treatment, while others might have better emergency situation coverage.

Some Ideas on Paul B Insurance You Need To Know

Sometimes, calling the strategies' customer support line may be the most effective method to get your concerns answered. Create your concerns down in advance of time, and also have a pen or electronic tool helpful to tape the responses. Below are some examples of what you could ask: I take a particular medication.

Ensure any kind of strategy you select will certainly pay for your routine as well as necessary treatment, like prescriptions and experts.

As you're searching for the right medical insurance, a good action is to determine which plan kind you require. Each plan type balances your prices as well as dangers in different ways. Think about your healthcare usage as well as budget to discover the one that fits.

Health and wellness insurance policy (likewise called health and wellness protection or a health insurance) aids you pay for medical care. All health and wellness insurance coverage plans are various. Each strategy costs a various amount of cash and also covers various solutions for you as well as participants of your household. When picking your insurance strategy, take some time to think of your family's clinical demands for the next year.

Some Known Incorrect Statements About Paul B Insurance

You can locate strategy recaps as well as obtain details regarding health and wellness strategies for you and also your kids in your state's Health and wellness Insurance coverage Industry. Each strategy in the Market has a summary that includes what's covered for you and your household.

When contrasting health and wellness insurance coverage plans, look at these expenses to assist you decide if the strategy is best for you: This is the quantity of cash you pay monthly for insurance. This is the quantity of money you need to spend before the strategy starts paying for your health and wellness care.

Your insurance deductible does not include your premium. (additionally called co-pay). This is the amount of cash you pay for each healthcare service, like a visit to a wellness care service provider. This is the highest possible amount of cash you would have to pay each year for wellness care solutions. You don't have to pay even more than this quantity, even if the services you require expense much more.

Right here's what to look for in a health plan when you're thinking of service providers: These providers have an agreement (agreement) with a health insurance plan to supply clinical solutions to you at a price cut. In a lot of cases, mosting likely to a preferred service provider is the least pricey way to get healthcare.

The 2-Minute Rule for Paul B Insurance

This means a health and wellness plan has various prices for different providers. You may need to pay even more to see some suppliers than others. If you or a relative currently has a healthcare service provider and you wish to maintain seeing them, you can figure out which intends include that company.

You can discover what solutions are covered by each health insurance plan in the on the internet Market. All plans need to cover prescriptions, yet each strategy covers them differently. A prescription is an order for medication offered by a wellness care carrier. If you make use of prescription medication, you can discover what prescriptions are covered by each health insurance plan in the on the internet Market.

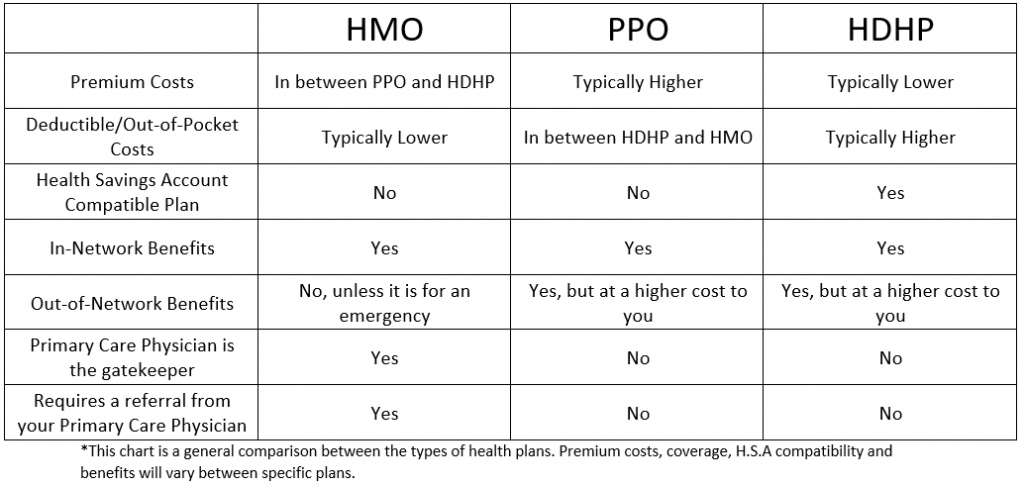

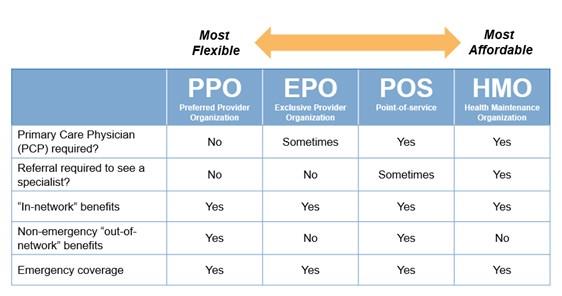

When comparing wellness insurance plans, comprehending the distinctions in between wellness insurance policy types can assist you pick a plan that's finest for you. Medical insurance is not one-size-fits-all, and the variety of choices shows that. There are several sorts of medical insurance plans to pick from, as well as each has actually associated costs as well as constraints on suppliers as well as check outs.

additional readingTo prosper of the video game, check your present medical care strategy to examine your protection dig this and also recognize your plan. And also, take a look at for more specific medical care strategy details. To figure out check these guys out exactly how State Farm may be able to aid with your health and wellness insurance coverage requires, call your representative today.

Paul B Insurance Fundamentals Explained

Healthcare facility cover is readily available in 4 different tiers, particularly Gold, Silver, Bronze, and also Fundamental, each covering a mandated listing of treatments. Since Gold policies cover all 38 kinds of therapies outlined by the government, they likewise feature the most expensive premiums.

If it's an indemnity plan, what kind? Is that HMO standard, or open-access? With numerous strategy names so obscure, how can we identify their kind? Considering that the Bureau of Labor Data (BLS) began reporting on clinical plans over thirty years back, it has actually recognized them by type. Naturally, strategies have actually altered fairly a bit in thirty years.

A plan that gets with medical carriers, such as medical facilities and also doctors, to create a network. People pay much less if they make use of companies who come from the network, or they can utilize companies outside the network for a higher expense. A plan making up groups of healthcare facilities as well as doctors that contract to supply comprehensive clinical services.

Such strategies commonly have varying protection levels, based on where solution occurs. The plan pays much more for solution performed by a minimal set of companies, much less for solutions in a wide network of carriers, as well as even much less for solutions outside the network. A strategy that provides pre paid extensive treatment.

The smart Trick of Paul B Insurance That Nobody is Talking About

In Exhibition 2, side-by-side comparisons of the six sorts of healthcare plans reveal the distinctions identified by responses to the 4 inquiries about the strategies' features. For example, point-of-service is the only plan kind that has greater than 2 degrees of advantages, and also fee-for-service is the only kind that does not use a network.

The NCS has actually not included plan kinds to account for these yet has classified them into existing strategy kinds. In 2013, 30 percent of clinical plan participants in exclusive market were in strategies with high deductibles, as well as of those workers, 42 percent had access to a wellness savings account.

Report this wiki page